Opening a bank account and managing financial transactions has become easier than ever with the advent of digital banking. One such innovative platform is Kuda Bank, a mobile-only bank that offers a seamless banking experience right at your fingertips.

In this modern era, where convenience and efficiency are paramount, knowing how to open a Kuda Bank account and navigate its features for payments and money transfers is essential. Whether you're looking to switch to digital banking or explore new banking options, this guide will provide you with a comprehensive understanding of how to open a Kuda Bank account and make payments or receive money using the Kuda Bank app.

Discover the simplicity and convenience of digital banking with Kuda Bank and empower yourself to manage your finances with ease.

Kuda Bank Signup and Registration: How To Open Kuda Bank Account

Opening a Kuda Bank account is a straightforward process that can be completed entirely through the Kuda Bank mobile app. Here's a step-by-step guide on how to open a Kuda Bank account:

Download the Kuda Bank app: Start by downloading the Kuda Bank app from the Google Play Store or Apple App Store, depending on your device's operating system.

Launch the app and sign up: Open the app and click on the "Sign Up" or "Create an Account" button. You will be prompted to provide your personal details, including your full name, phone number, email address, and residential address.

Verify your phone number: After entering your phone number, you will receive a verification code via SMS. Enter the code in the app to verify your phone number.

Set up your account: Once your phone number is verified, you will need to set up a secure PIN or password for your Kuda Bank account. This PIN or password will be used to log in to your account in the future, so make sure it is unique and memorable.

Complete your profile: Next, you will be asked to provide additional details to complete your profile, such as your date of birth, occupation, and ID card information (e.g., driver's license, national ID, or international passport).

Take a selfie and submit your ID: As part of the account opening process, you will be required to take a selfie and upload a photo of your ID card. Make sure the ID card is valid and legible for successful verification.

Confirm your identity: Once you have uploaded your selfie and ID card, Kuda Bank will verify your identity. This process may take a few minutes, and you will receive a notification once your identity is successfully verified.

Fund your account: To start using your Kuda Bank account, you will need to fund it. The app provides options to fund your account through bank transfers or debit card payments.

Explore Kuda Bank features: Once your account is funded, you can start exploring the various features and services offered by Kuda Bank. These include making payments, transferring money, accessing your account statements, and managing your finances directly from the app.

Ensure that you have a stable internet connection and provide accurate information during the account setup process to avoid any issues.

How To Send Money With Kuda

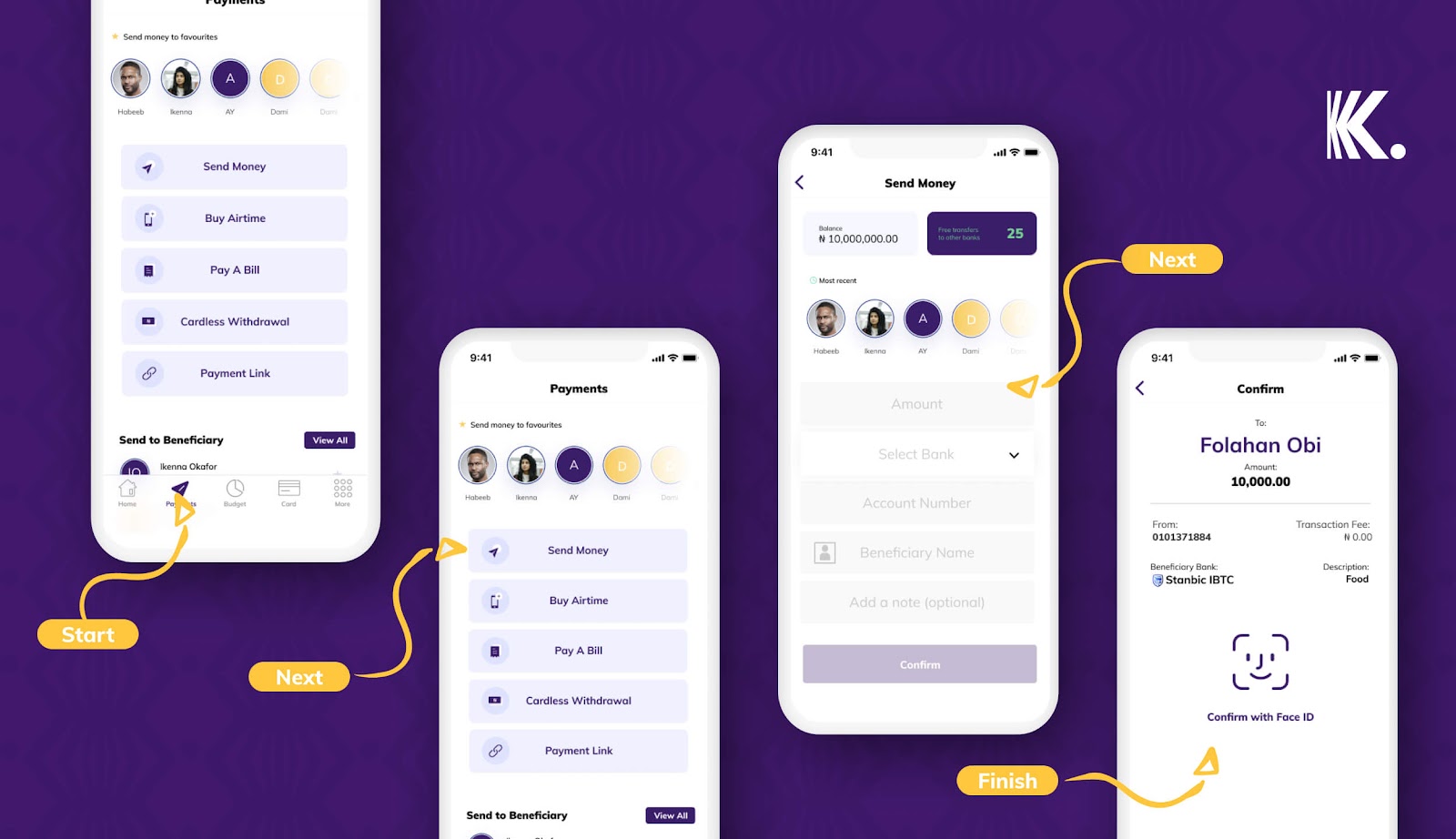

Sending money with Kuda Bank is a seamless process that can be done quickly and securely through the Kuda Bank mobile app. Follow these step-by-step instructions to send money to another individual:

Launch the Kuda Bank app: Open the Kuda Bank app on your mobile device and log in to your account using your secure PIN or password.

Navigate to the "Send Money" feature: Once you're logged in, locate and tap on the "Send Money" or "Transfer" option within the app's navigation menu. This will take you to the money transfer interface.

Select the recipient: On the transfer interface, you will be prompted to enter the recipient's details. You can choose to send money to someone in your contact list or manually enter their bank account details, such as their account number, bank name, and bank branch.

Enter the transfer amount: After selecting the recipient, specify the amount you wish to send. Ensure that you enter the correct amount to avoid any errors.

Review the transaction details: Before confirming the transfer, take a moment to review the transaction details. Double-check the recipient's information, transfer amount, and any associated fees, if applicable.

Confirm and authorize the transfer: Once you are satisfied with the transaction details, confirm and authorize the transfer. You may be prompted to enter your secure PIN or provide biometric authentication (e.g., fingerprint or face recognition) to complete the transaction.

Transaction notification: After successfully authorizing the transfer, you will receive a transaction confirmation notification within the app. The recipient will also be notified of the incoming funds.

Track your transaction: Kuda Bank provides a transaction history feature that allows you to track your transfers. You can view the status and details of your transaction within the app.

It's important to note that certain limits may apply to the amount you can send per transaction or within a specific time frame. These limits may vary based on factors such as your account type, transaction history, and Kuda Bank's policies. Make sure to familiarize yourself with any applicable limits and fees associated with sending money through Kuda Bank.

How To Receive Money With Kuda Bank

To receive money with your Kuda Bank account, you do not need to share your account details publicly. Instead, you can provide the sender with your Kuda Bank account number and other necessary information privately. Follow these steps to receive money into your Kuda Bank account:

Share your Kuda Bank account number: Provide the sender with your unique Kuda Bank account number. This is a 10-digit number that identifies your account and can be found in the Kuda Bank app by navigating to the "Accounts" section or on your account statement.

Await the incoming transfer: Once you have shared your Kuda Bank account number, the sender can initiate the transfer from their bank or payment app. It may take some time for the transfer to be processed, depending on the sender's bank and the chosen transfer method.

Check your account balance: After the sender has initiated the transfer, monitor your Kuda Bank account balance. You can do this by logging into the Kuda Bank app and navigating to the "Accounts" section, where you will see your available balance and any incoming transactions.

Transaction notification: Kuda Bank will notify you through the app when the funds have been successfully credited to your account. You can also keep an eye out for email or SMS notifications if you have opted to receive them.

Accessing the received funds: Once the money is in your Kuda Bank account, you can freely use it for various purposes, such as making payments, transferring funds to others, or withdrawing cash from ATMs that accept Kuda Bank cards.

Remember to keep your account details secure and only share them with trusted individuals or entities. Avoid sharing your personal banking information on public platforms or with unknown sources to protect your account from unauthorized access.

Read Also: How To Open Palmpay Account/How to Make Payments(send and receive money) With Palmpay

Additional Features Of Kuda Account

In addition to opening a Kuda Bank account and making payments, there are several additional features and benefits that come with a Kuda account. Here are some notable features of a Kuda account:

Budgeting and savings tools: Kuda provides built-in budgeting and savings features within their app. You can set spending limits, categorize your expenses, and track your savings goals. This helps you manage your finances more effectively and stay on top of your financial goals.

Automatic savings: Kuda allows you to automate your savings by setting up recurring transfers from your Kuda account to your savings goals. This feature makes it easier to save money regularly without the need for manual transfers.

Instant notifications and alerts: With Kuda, you receive instant notifications and alerts for every transaction on your account. This helps you stay informed about your financial activities and ensures that you are aware of any unauthorized or suspicious transactions.

Split bills and group payments: Kuda enables you to split bills and make group payments with ease. Whether you're sharing expenses with friends or splitting the cost of a meal, you can use the app to request money from others and settle shared expenses seamlessly.

Virtual card: Kuda provides a virtual card that you can use for online transactions. This virtual card offers convenience and security for online payments, and you can easily view your card details within the app.

Bill payments and airtime top-up: With your Kuda account, you can conveniently pay bills such as electricity, internet, cable TV, and more, directly from the app. Additionally, you can top up airtime for your mobile phone or that of your loved ones using the Kuda app.

ATM withdrawals: Kuda allows you to withdraw cash from ATMs using your Kuda debit card. You can locate the nearest ATM within the app and withdraw cash when needed.

Customer support: Kuda provides responsive and reliable customer support through various channels, including in-app chat support. If you have any questions or encounter any issues, you can reach out to their customer support team for assistance.

These additional features enhance the functionality and convenience of your Kuda account, providing you with a comprehensive banking experience right from your mobile device.

FAQS

How do I receive money on Kuda?

To receive money on your Kuda account, simply provide the sender with your Kuda account number and account name. They can initiate a transfer to your Kuda account from their own bank or through other payment platforms.

How can someone send money to my Kuda account?

To receive money on your Kuda account, share your Kuda account number and account name with the sender. They can use this information to send money directly to your Kuda account through their own bank or payment platforms.

Can I send and receive money on Kuda without BVN?

No, having a Bank Verification Number (BVN) is a requirement to open and operate a Kuda account. BVN is a unique identification number that links your bank accounts and personal information. It is mandatory for financial transactions in Nigeria, including sending and receiving money on Kuda.

How much is naira to dollar on Kuda?

The exchange rate between the Nigerian Naira (NGN) and the US Dollar (USD) on Kuda may vary depending on market conditions. It is recommended to check the Kuda app or website for the most up-to-date exchange rates.

How much can Kuda receive at once?

Kuda does not impose a specific limit on how much money you can receive at once. However, there may be certain transaction limits or restrictions imposed by your bank or payment platforms when receiving large sums of money. It is advisable to check with your bank or Kuda's support team for any specific limits or requirements.

Conclusion

In conclusion, opening a Kuda Bank account and making payments with the Kuda Bank app is a convenient and user-friendly experience. With simple steps to open an account and a range of features within the app, Kuda Bank offers a seamless banking solution for individuals seeking modern and efficient banking services.