Moniepoint is a fast-growing digital platform that has gained popularity among many Nigerians for its convenience and ease of use. With the rise of digital banking and online transactions, Moniepoint offers a safe and secure way to keep your money.

However, as with any financial platform, it is important to understand its safety measures and benefits before entrusting it with your hard-earned cash. In this blog post, we will explore the safety of Moniepoint, its advantages, and answer some frequently asked questions about the platform. Read on to learn more about Moniepoint and whether it is the right choice for managing your money.

What Are The Features Of Moniepoint

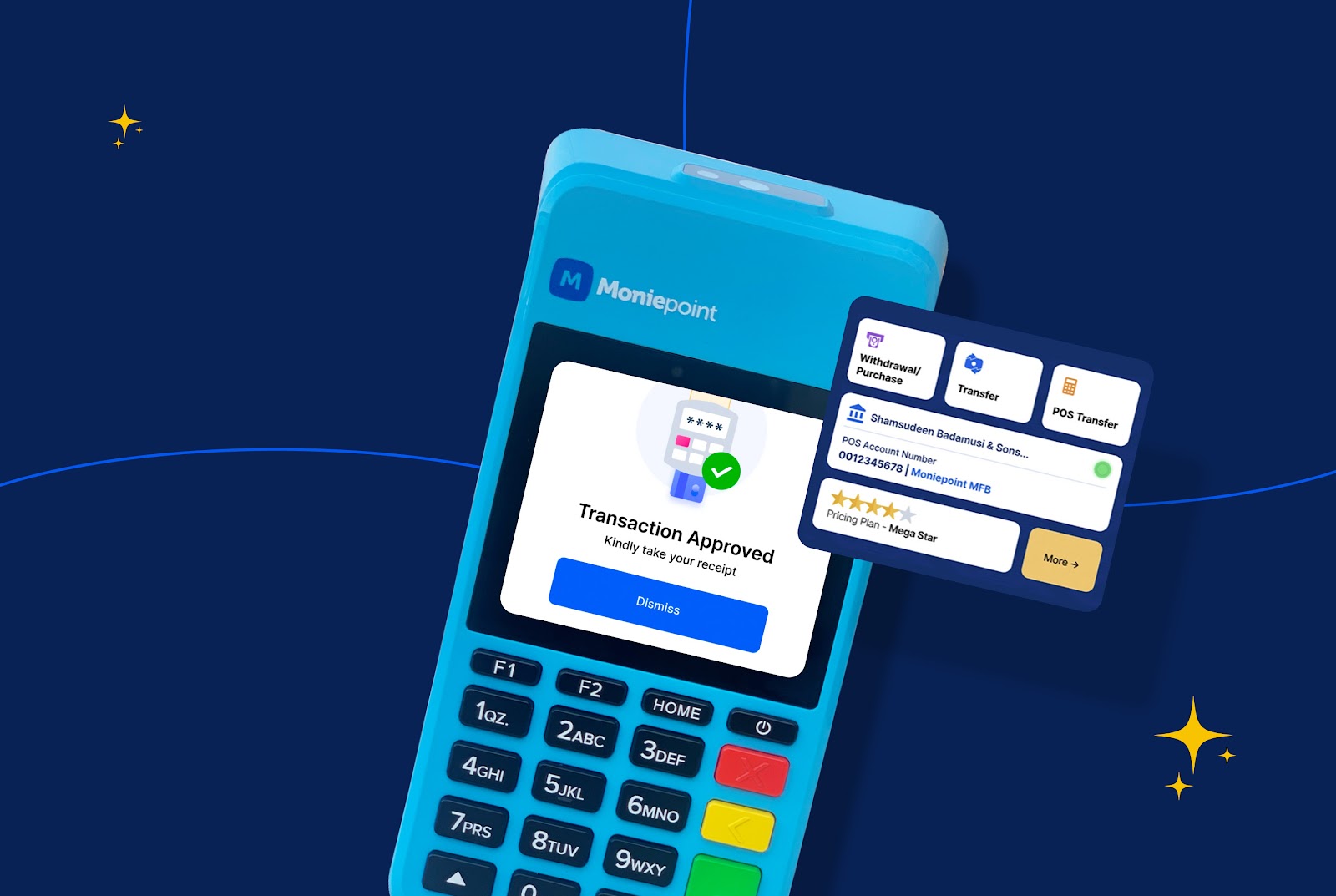

Moniepoint offers a range of features that make it a popular choice among Nigerians for managing their money. Here are some key features of the platform:

- Mobile App: Moniepoint provides a user-friendly mobile app that allows you to easily access your account and perform transactions on the go. With just a few taps, you can transfer money, pay bills, and even purchase airtime and data.

- Quick and Easy Transactions: Moniepoint ensures that your transactions are processed swiftly, allowing you to send and receive money in no time. Whether you're sending money to family and friends or making payments for goods and services, Moniepoint streamlines the process for maximum efficiency.

- High Security Measures: Moniepoint prioritizes the security of your funds. They employ robust encryption technology to protect your personal and financial information. Additionally, they have implemented strict verification processes to ensure that only authorized individuals can access your account.

- 24/7 Customer Support: If you ever encounter any issues or have questions about using Moniepoint, their dedicated customer support team is available round the clock to assist you. You can reach out to them via phone, email, or through the in-app chat feature.

- Cashback and Rewards: Moniepoint also offers cashback and rewards programs to incentivize users. By using the platform for your transactions, you can earn cashback on certain purchases or accumulate points that can be redeemed for various benefits.

Overall, the features provided by Moniepoint make it a reliable and convenient platform for managing your money.

Is Moniepoint Safe To Keep Money?

When it comes to keeping your money safe, Moniepoint takes its responsibility seriously. With the increasing popularity of digital banking and online transactions, security is a top priority. Moniepoint understands this and has implemented high-security measures to ensure the safety of your funds.

They utilize robust encryption technology to protect your personal and financial information from unauthorized access. Additionally, strict verification processes are in place to ensure that only authorized individuals can access your account. This provides an added layer of security and peace of mind.

Furthermore, Moniepoint's dedication to customer support is evident in their 24/7 availability. If you ever encounter any issues or have questions, their customer support team is ready to assist you promptly.

Overall, Moniepoint is committed to keeping your money safe and secure. You can trust this digital platform to protect your hard-earned cash and provide you with a reliable and convenient way to manage your finances.

Benefits Of Using Moniepoint

Moniepoint offers a range of benefits that make it an attractive choice for managing your money. Here are some key advantages of using the platform:

- Convenience: Moniepoint's mobile app allows you to perform transactions on the go, making it incredibly convenient for your busy lifestyle. Whether you need to send money to a loved one or pay bills, you can do it all with just a few taps on your phone.

- Speed: With Moniepoint, your transactions are processed quickly, allowing you to send and receive money in no time. Say goodbye to waiting in long bank queues or dealing with slow online payment platforms.

- Security: Moniepoint prioritizes the safety of your funds. With their robust encryption technology and strict verification processes, you can trust that your personal and financial information is protected from unauthorized access.

- 24/7 Customer Support: Moniepoint's dedicated customer support team is available round the clock to assist you. If you have any issues or questions about using the platform, they are just a phone call, email, or in-app chat away.

- Cashback and Rewards: Moniepoint offers cashback and rewards programs that allow you to earn benefits for using the platform. By simply using Moniepoint for your transactions, you can earn cashback or accumulate points that can be redeemed for various perks.

Overall, Moniepoint provides a convenient, secure, and rewarding experience for managing your money. With its user-friendly features and excellent customer support, it's no wonder that many Nigerians trust Moniepoint with their finances.

Read Also: Branch Loan App Download, Signup, Interest Rates, Loan Code – Is Branch Loan Legit, Approved by CBN?

FAQS

How safe is Moniepoint?

Moniepoint is a licensed and regulated financial institution, and your funds are insured by the Nigeria Deposit Insurance Corporation (NDIC). This means that your funds are protected up to a certain amount in the event of the institution's failure. Moniepoint also employs a variety of security measures to protect your data and transactions, including 2FA, encryption, and firewalls.

Can I use Moniepoint for personal use?

Yes, you can use Moniepoint for personal use. However, it is primarily designed for businesses, and some of its features, such as the ability to accept payments, may not be relevant to personal users. If you are looking for a personal banking solution, you may want to consider a traditional bank or credit union.

What are the benefits of a Moniepoint business account?

A Moniepoint business account offers a number of benefits for businesses, including:

- The ability to accept card payments

- Access to working capital loans

- A business debit card

- A savings account

- A simple and easy-to-use online platform

What are the benefits of keeping your money in a bank?

There are many benefits to keeping your money in a bank, including:

- Safety: Your money is insured by the NDIC

- Convenience: You can access your money through ATMs, online banking, and mobile banking

- Interest: You can earn interest on your money

- Protection: Your money is protected from theft and loss

Is it safe to keep lots of money in a bank?

Yes, it is safe to keep lots of money in a bank. Your money is insured by the NDIC up to a certain amount, and banks are required to take a number of security measures to protect your funds. However, it is important to remember that no financial institution is completely immune to risk, and there is always a small chance that you could lose money if the bank fails. If you are concerned about keeping large amounts of money in a bank, you may want to consider investing in other assets, such as stocks, bonds, or real estate.

Conclusion

In this blog post, we have explored the safety measures and benefits of using Moniepoint to manage your money. We have learned that Moniepoint offers a range of convenient features, such as a user-friendly mobile app, quick and easy transactions, high security measures, and 24/7 customer support. These features make it a reliable and efficient platform for your financial needs.

In conclusion, Moniepoint is a safe, secure, and advantageous platform for managing your finances. Give it a try and experience the convenience and peace of mind it offers.