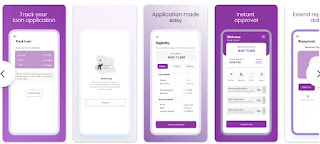

Are you looking for a reliable and user-friendly platform to borrow funds quickly and conveniently? Look no further, as Mama Credit Loan App is here to cater to your financial needs with efficiency and ease.

In this comprehensive guide, we will walk you through the simple yet effective process of downloading the Mama Credit Loan App apk and provide you with all the necessary customer care details to ensure a seamless borrowing experience. Whether it's an unexpected emergency or a planned expense, Mama Credit Loan App is your go-to solution, offering a wide range of borrowing options tailored to suit your individual requirements.

How to Borrow from Mama Credit Loan App

Borrowing from Mama Credit Loan App is a straightforward and convenient process that empowers users to access funds quickly and efficiently. Whether you have an urgent financial need or want to fund a personal project, Mama Credit Loan App offers a user-friendly platform that ensures a seamless borrowing experience. Here's a comprehensive guide on how to borrow from Mama Credit Loan App:

Step 1: Download the Mama Credit Loan App The first step is to download the Mama Credit Loan App on your smartphone. You can find the official app on the Google Play Store for Android devices or the Apple App Store for iOS devices. Simply search for "Mama Credit Loan App" and tap the "Install" or "Download" button to get the app on your phone.

Step 2: Install and Register After downloading the app, open it and proceed to register as a new user. You will need to provide some basic information such as your name, email address, mobile number, and create a password. Ensure that the information you provide is accurate as it will be used for verification and communication purposes.

Step 3: Complete Your Profile Once you have registered, you will be prompted to complete your profile by providing additional details like your date of birth, address, employment status, and income. This information helps Mama Credit Loan App assess your creditworthiness and determine the loan amount you are eligible to borrow.

Step 4: Choose the Loan Amount and Repayment Term After completing your profile, you can now choose the loan amount you wish to borrow and the repayment term that suits your financial capacity. Mama Credit Loan App typically offers a range of loan amounts with different repayment options, allowing you to find the most suitable option for your needs.

Step 5: Submit Loan Application Once you've selected your loan amount and repayment term, review the terms and conditions before submitting your loan application. Double-check all the details to ensure accuracy. After submission, the Mama Credit Loan App will quickly process your application and assess your eligibility.

Step 6: Loan Approval and Disbursement Upon approval of your loan application, you will receive a notification indicating the successful approval of your loan. The funds will be disbursed directly to your registered bank account or mobile money account, depending on your chosen disbursement method. Mama Credit Loan App strives to disburse funds swiftly to meet your urgent financial needs.

Step 7: Repayment Repayment is typically done through the Mama Credit Loan App as well. The app will notify you of your repayment schedule and the due dates. You can choose to make repayments through various options provided by the app, such as mobile money, debit card, or direct bank transfer.

Step 8: Customer Care Support Throughout the borrowing process, Mama Credit Loan App offers excellent customer care support to address any queries or concerns you may have. If you encounter any issues or need assistance at any stage, you can reach out to their dedicated customer care team via phone, email, or in-app chat.

It is important to remember that responsible borrowing is essential to maintain a healthy financial profile. Borrow only what you can comfortably repay and avoid defaulting on loan payments. Timely repayments will also improve your creditworthiness, making you eligible for higher loan amounts and better terms in the future.

Read Also: 10 Mistakes Beginner Bloggers Should Avoid in 2023

Requirement To Borrow Money From Mama Credit Loan App

To borrow money from the Mama Credit Loan App, there are certain requirements that applicants must meet. These requirements are put in place to ensure responsible lending and to assess the borrower's creditworthiness. While specific requirements may vary depending on the country or region where Mama Credit operates, here are some common eligibility criteria you may need to meet:

- Age Limit: You must be of legal age to apply for a loan. In many regions, this is typically 18 years or older.

- Valid Identification: You will need a valid government-issued identification document, such as a national ID card, passport, or driver's license.

- Mobile Phone and App: As the loan application process is usually done through the Mama Credit Loan App, you will need a smartphone with an internet connection and the app installed.

- Residential Address: You may be required to provide proof of your residential address, such as a utility bill or a rental agreement.

- Steady Source of Income: Most loan apps require applicants to have a steady source of income. This can be in the form of regular employment, self-employment, or any other verifiable source of income.

- Bank Account or Mobile Money Account: You will need a valid bank account or mobile money account for the loan disbursement. This is where the approved loan amount will be deposited.

- Credit Check and Score: Mama Credit Loan App may conduct a credit check to assess your credit history and repayment behavior. Having a good credit score can improve your chances of loan approval.

- Meeting Minimum Income Criteria: Some loan apps have minimum income criteria that applicants must meet to be eligible for borrowing. This ensures that borrowers have the financial capacity to repay the loan.

- Compliance with Local Regulations: You must comply with the legal and regulatory requirements of the country or region where Mama Credit operates.

It's essential to carefully review the specific requirements mentioned within the Mama Credit Loan App and ensure that you meet all the eligibility criteria before applying for a loan. Additionally, keep in mind that borrowing responsibly and within your means is crucial to maintaining healthy financial well-being.

Mama Credit Loan App Apk Download

To download the APK version of Mama Credit loan app, simply search for the app on Google, and you will be able to download them from the list of provided apps to you from Google searches.

Mama Credit Customer Care Details

If you will like to make any enquiries, you can connect with Mama credit via any of the below channels.

Phone number: 0816 630 1112

Email: [email protected]

Address: H3, Ajorosun Street, Odo Ona, Moniya, Ibadan

With the above details, you can easily connect with their customer care team, whenever you have any enquiries.

FAQS

How can I borrow money from my mobile phone?

Borrowing money from your mobile phone has become increasingly convenient with the rise of loan apps. To borrow money, follow these general steps:

- Download a reputable loan app from the App Store or Google Play Store.

- Register and create an account on the app with your personal and contact details.

- Complete your profile and provide any additional information required for verification.

- Choose the loan amount and repayment term that suits your needs.

- Submit your loan application through the app.

- Once approved, the funds will be disbursed directly to your registered bank account or mobile money account.

How do you get a loan from an app?

Getting a loan from an app is a simple and quick process. Here's how:

- Download the loan app from the official app store.

- Register and create an account with your relevant information.

- Complete any necessary verification steps, such as ID verification or linking your bank account.

- Select the loan amount and repayment terms that fit your requirements.

- Submit your loan application within the app.

- Wait for the loan approval decision, which is usually processed quickly.

- Upon approval, the loan amount will be disbursed to your specified account, ready for use.

How do I borrow money from Newcredit?

To borrow money from Newcredit, follow these steps:

- Download the Newcredit Loan App from your app store.

- Register and create an account with accurate personal and contact information.

- Complete your profile, providing details requested by Newcredit for verification.

- Choose the loan amount and repayment duration that suits you best.

- Submit your loan application through the app.

- Once your application is approved, the loan amount will be transferred to your bank account or mobile money account.

Can I borrow money from PalmPay?

Yes, you can borrow money from PalmPay. PalmPay is known to offer loans through its app. To borrow from PalmPay, follow these general steps:

- Download the PalmPay app from your app store and install it on your mobile phone.

- Register and create an account on the app, providing the required personal information.

- Complete any verification steps required by PalmPay, such as providing your ID details.

- Select the loan amount and repayment period that aligns with your needs.

- Submit your loan application through the app.

- Once approved, the loan amount will be disbursed to your linked bank account or mobile money wallet.

How to borrow $50,000 from PalmPay?

The process to borrow $50,000 from PalmPay would generally follow these steps:

- Download and install the PalmPay app on your mobile device.

- Register and create an account, providing accurate personal information and necessary details.

- Complete any verification requirements requested by PalmPay.

- Choose the loan amount of $50,000 and select a suitable repayment duration.

- Submit your loan application through the PalmPay app.

- The loan application will be reviewed, and upon approval, the $50,000 will be credited to your specified bank account or mobile money wallet.

Conclusion

In conclusion, Mama Credit Loan App emerges as a reliable and user-friendly platform, providing a seamless borrowing experience to individuals seeking quick and convenient access to funds. With the easy-to-follow steps on how to borrow from the app, users can navigate the entire process effortlessly, from downloading the Mama Credit Loan App apk to receiving funds directly in their bank or mobile money accounts.

Furthermore, the app's comprehensive customer care details ensure that borrowers have access to prompt assistance and support whenever needed. Whether it's clarifying loan terms, addressing concerns, or seeking guidance on repayment, Mama Credit's dedicated customer care team is readily available to assist throughout the borrowing journey.